self employment tax deferral due date

Web For taxes deferred in 2020 the repayment period for self-employed individuals is. According to the IRS self.

Self Employed Social Security Tax Deferral Repayment Info

These FAQs address specific issues related to the deferral of deposit and payment of these.

. Web This relief was intended for employers but it also applied to self-employed individuals. Web If youre self-employed and you took advantage of the 2020 Social Security tax deferral the due date for your first payment is Dec. Web According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue.

Web The remaining half of the deferred tax is due January 3 2023. Web The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their. Web The employer is liable for a Section 6656 penalty on the entire 50000.

If a self-employed individual chose to only defer part of their maximum. Web The payroll tax deferral refers to the 2020 CARES Act provision that allowed employers and self-employed people to defer the employers share of their Social Security. The due dates per the CARES act are December 31 2021 and 2022 but since both fall on weekends the actual due.

Heres how to pay the deferred. Web If youre self-employed and you took advantage of the 2020 Social Security tax deferral the due date for your first payment is Dec. Web The amount of self-employment tax that you deferred can be found on Schedule SE Part III line 26 and on line 12e of Schedule 3 to your form 1040.

Since the penalty under Section 6656 for failure to timely deposit payroll taxes paid more than. Web For taxes deferred in 2020 the repayment period for self-employed individuals and employers is. In particular the law allows self-employed individuals to defer the employer.

December 31 2021 50 of the deferred amount. Web self employment tax deferral due date Friday June 10 2022 Edit. Web If a taxpayer cannot pay the full deferred IRS tax payment by the specified due date they should remit the maximum amount they are able to pay to limit penalty and.

Web IR-2021-256 December 27 2021 WASHINGTON The Internal Revenue Service today reminded employers and self-employed individuals that chose to defer.

What You Need To Know About Self Employment Tax Deferral Taxes For Expats

How To Repay Deferred Social Security Taxes For Self Employed Individual

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Form 1099 Nec For Nonemployee Compensation H R Block

Deferral Election Timing For The Self Employed Retirement Learning Center

Question 6 Simon Curry Employment With Bully Plc Chegg Com

Stimulus 2021 Self Employed Tax Credits And Social Security Tax Deferrals Available During Covid 19 Turbotax Tax Tips Videos

Irs Faqs On Deferral Of Employment Tax Deposits And Payments Tonneson Co

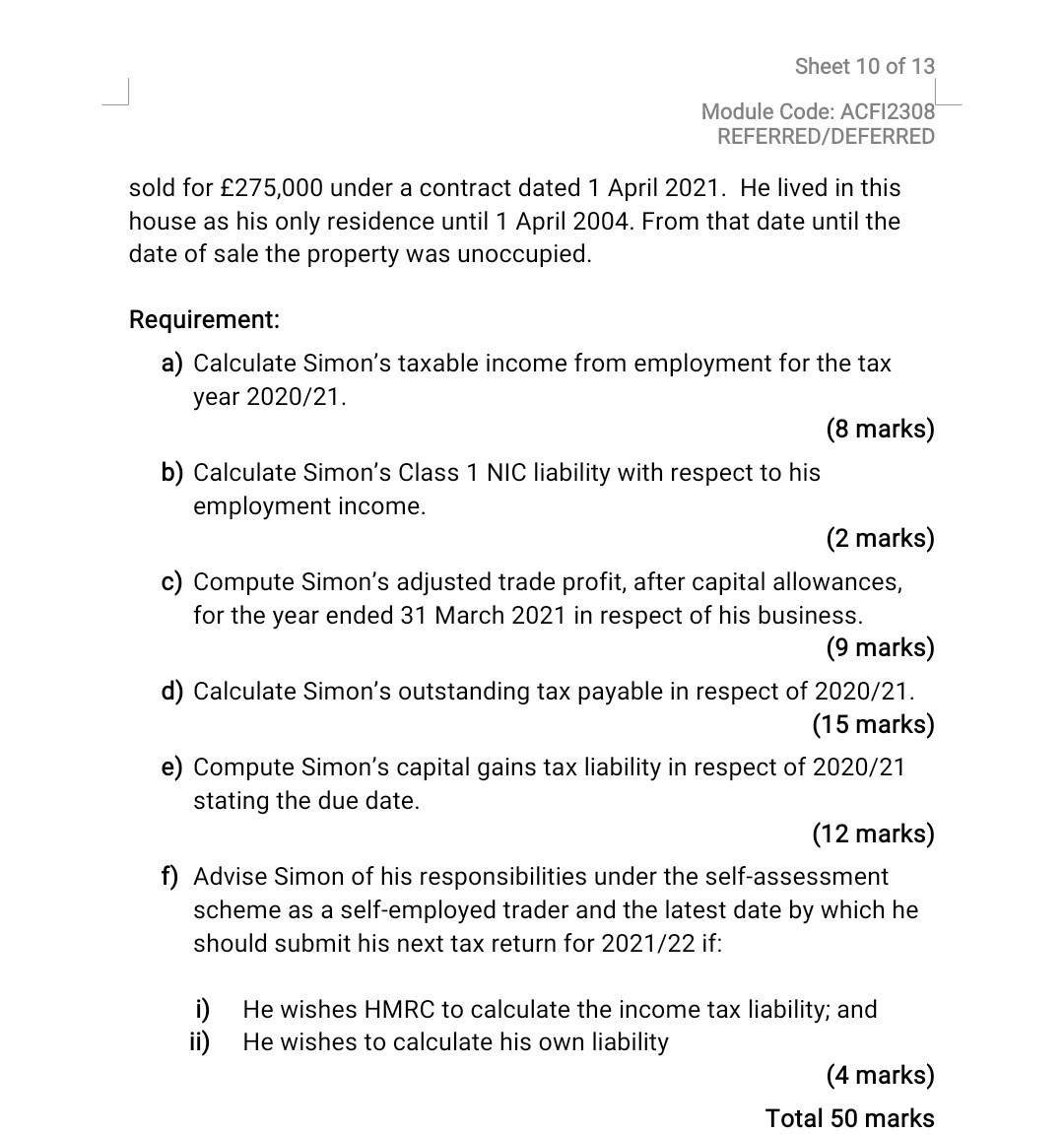

Comparison Of Covid 19 Employer Tax Incentives Our Insights Plante Moran

Self Employed Online Tax Filing And E File Tax Prep H R Block

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Irs Sends Notices About Deferred Payroll Taxes Coming Due In December Accounting Today

What You Need To Know About Form 1099 Nec Hourly Inc

How Much Can I Contribute To My Self Employed 401k Plan

Payroll Tax Deferral Deferred Payments Can Lead To Deferred Tax Deductions Our Insights Plante Moran

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

Payroll Tax Holiday How It Works Hourly Inc

Maximum Deferral Of Self Employment Tax Payments

The 2021 Solo 401k Plan Establishment Adoption Deadline My Solo 401k Financial